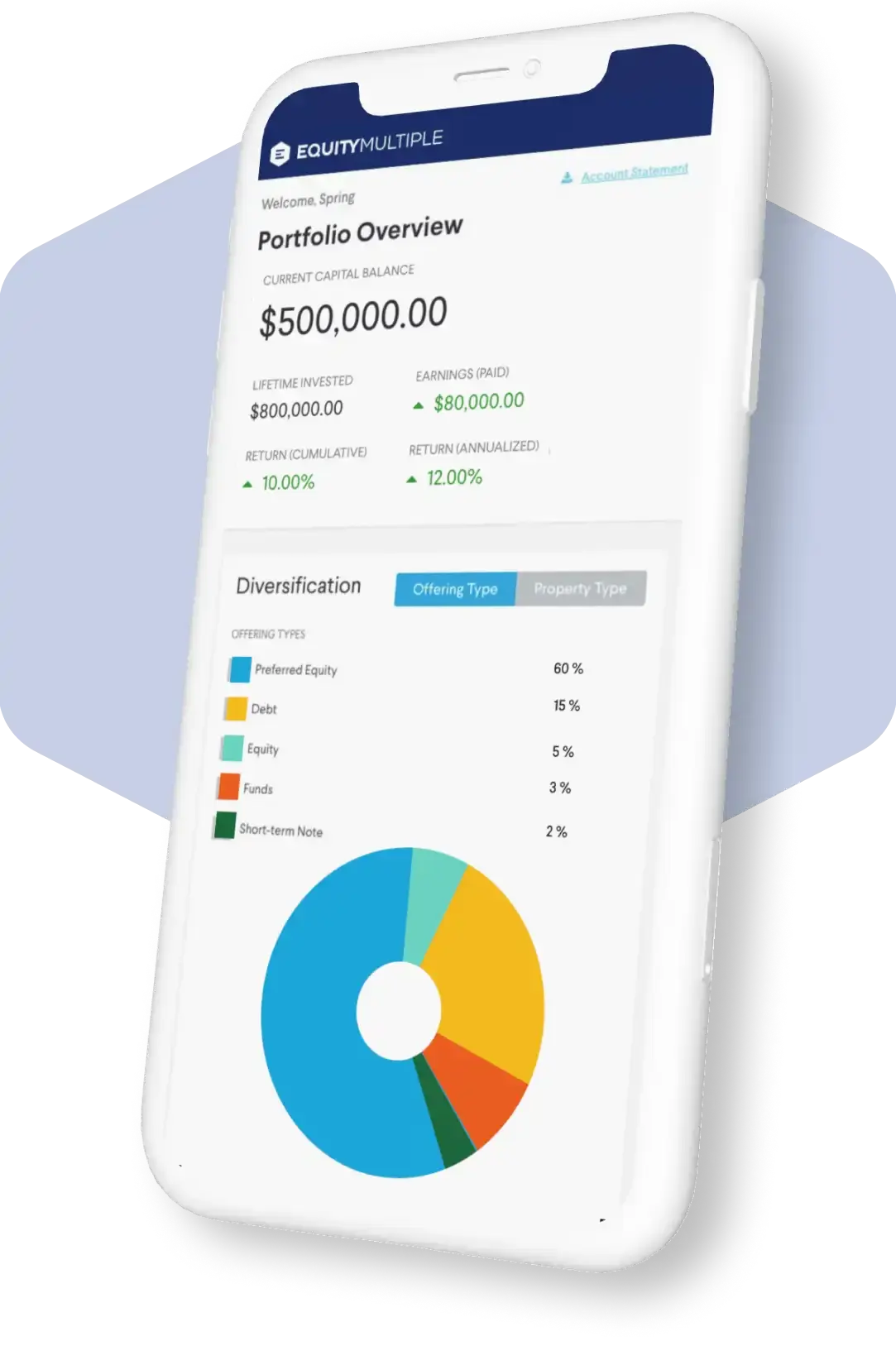

2. Distributions to Investors refers to the sum of any interest, preferred return or income distributions, sale gains, and return of capital after deduction of fees and investment related expenses, excluding tax withholding. Updated between inception (2/1/15) and the end of the last full calendar quarter.

This material is confidential and has been prepared solely for the information of the intended recipient and may not be reproduced, distributed, or used for any other purpose or shared with anyone in any form or format. This has been prepared for you by EM Advisor, LLC (“EM”), an SEC registered investment advisor. Information within this report may have been provided by third-parties, including images displayed, and, while EM believes this information to be accurate, EM has not independently verified such information. Reference to registration with the Securities and Exchange Commission (“SEC”) does not imply that the SEC has endorsed or approved the qualifications of the firm or its respective representatives to provide any advisory services described on the report or that the Firm has attained a level of skill or training. Investments in securities are not FDIC insured, are not bank guaranteed and may lose value. Investing in securities involves risks, and there is always the potential of losing money when you invest in securities. Additionally, investments may not achieve stated social, environmental, or similar objectives. Before investing, consider your investment objectives and EM charges and expenses. EM advisory services are designed to assist clients in achieving discrete financial goals. They are not intended to provide financial planning with respect to every aspect of a client’s financial situation, they do not incorporate investments that clients hold elsewhere, and they do not provide tax advice. Past performance does not guarantee future results, and the likelihood of investment outcomes are hypothetical in nature. Nothing in this presentation constitutes an offer, solicitation of an offer, or advice to buy or sell securities in jurisdictions where EM is not registered. All rates of return or IRR are net of fees unless explicitly stated otherwise. The performance results provided herein may represent the hypothetical back-test of the criteria of the strategy, do not reflect actual trading by Equity Multiple, and do not represent the actual performance achieved by any EquityMultiple investor. Data is obtained from sources that are believed to be reliable. The following are limitations inherent in the presented hypothetical back-tested performance results: It is assumed that the securities used in the hypothetical back-tested results were available for purchase or sale during the time period presented and the markets were sufficiently liquid to permit the types of trading used. In addition, back-testing assumes purchase and sale prices believed to be attainable. Trades for the hypothetical returns were not actually executed. Hypothetical back-tested performance also differs from actual performance because, as noted, it is achieved through the retroactive application of screening designed with the benefit of hindsight. As a result, the screening process theoretically can continue to be changed until desired or better performance results are achieved. Further, back-tested screening performance does not represent the impact of technical factors, such as:

No communication by EquityMultiple, Inc. or any of its affiliates (collectively, “EquityMultiple”), through this website or any other medium, should be construed or is intended to be a recommendation to purchase, sell or hold any security or otherwise to be investment, tax, financial, accounting, legal, regulatory or compliance advice. Nothing on this website is intended as an offer to extend credit, an offer to purchase or sell securities or a solicitation of any securities transaction.